Pipeline Health Metrics Every CRM Should Track in 2025 presents a compelling exploration of the evolving landscape of Customer Relationship Management (CRM) and its profound impact on sales pipeline management. The shift in CRM usage has redefined how businesses approach sales, necessitating a proactive and data-driven approach to maintain pipeline health. This examination delves into the critical role of these metrics in achieving sales targets, navigating the future trends of CRM, and ensuring a robust sales strategy in the coming years.

This discussion will explore the foundational metrics, opportunity-specific analyses, and stage-based assessments crucial for understanding pipeline performance. Further investigation into velocity metrics, forecast accuracy, and engagement indicators will provide a comprehensive view of the sales process. We will then explore how deal source metrics, sales cycle duration, and customer health indicators can be effectively utilized. Finally, we will examine the best practices for reporting, automation, training, and integration to optimize data-driven decision-making.

Introduction: The Evolving Landscape of CRM and Pipeline Health

The landscape of Customer Relationship Management (CRM) is undergoing a significant transformation. CRM systems are no longer just tools for managing contacts and tracking interactions; they’ve evolved into strategic platforms for driving sales, enhancing customer experiences, and optimizing business operations. This shift necessitates a proactive approach to pipeline management, where the health of the sales pipeline is continuously monitored and optimized to achieve sales targets and drive revenue growth.

The future of CRM will be heavily influenced by technologies like AI, machine learning, and advanced analytics, which will further refine the metrics that matter in 2025 and beyond.

Proactive pipeline health monitoring is crucial for achieving sales targets. By closely tracking key metrics, sales teams can identify potential bottlenecks, forecast revenue accurately, and make data-driven decisions to improve performance. This involves a shift from reactive problem-solving to a proactive, predictive approach, where potential issues are addressed before they impact sales outcomes. Future trends in CRM, such as enhanced automation, personalized customer experiences, and predictive analytics, will further emphasize the importance of these metrics.

Future Trends in CRM and their Influence on Metrics

The future of CRM is shaped by several key trends, each impacting the metrics that sales teams must monitor. Artificial intelligence (AI) and machine learning will enable predictive analytics, providing insights into deal probabilities, customer behavior, and sales cycle optimization. Automation will streamline data collection and analysis, reducing manual effort and improving data accuracy. Personalized customer experiences will require tracking engagement metrics to understand individual customer preferences and tailor interactions accordingly.

In 2025, the focus will be on metrics that provide real-time insights, enable predictive capabilities, and drive personalized customer engagement. This includes a deeper understanding of customer health, sales cycle velocity, and the effectiveness of various lead sources.

Foundational Metrics: Essential Data Points for Pipeline Visibility: Pipeline Health Metrics Every CRM Should Track In 2025

Foundational metrics form the bedrock of a healthy sales pipeline, providing essential data points for visibility and decision-making. These metrics offer a comprehensive overview of the pipeline’s health, enabling sales teams to identify areas for improvement and drive better outcomes. Understanding and tracking these core metrics is the first step towards building a robust sales strategy.

Core Metrics and Calculation Methods, Pipeline Health Metrics Every CRM Should Track in 2025

Several core metrics are crucial for a healthy sales pipeline. Understanding how to calculate these metrics is vital for accurate monitoring and analysis.

- Number of Opportunities: This metric represents the total number of active deals in the pipeline. It’s a simple count and provides a high-level view of the pipeline’s volume.

- Pipeline Value: The total monetary value of all open opportunities in the pipeline. Calculated by summing the potential value of each deal.

- Average Deal Size: The average value of each closed deal. Calculated by dividing the total revenue from closed deals by the number of closed deals.

- Conversion Rate: The percentage of opportunities that move from one stage to the next, or that close successfully. Calculated by dividing the number of opportunities that advance to the next stage (or close) by the total number of opportunities in the previous stage.

- Sales Cycle Length: The average time it takes for a deal to move from the initial stage to closure. Calculated by determining the time elapsed between the opportunity creation date and the close date for closed deals.

Effective Visualization with Dashboards

Effective visualization of foundational metrics is critical for quickly understanding pipeline health. Dashboards provide a centralized view of key performance indicators (KPIs), enabling sales teams to monitor progress and identify trends.

- Pipeline Overview: A visual representation of the total number of opportunities, pipeline value, and average deal size, often presented as a bar chart or a summary table.

- Conversion Rate by Stage: A funnel chart or a series of bar charts showing the conversion rates at each stage of the sales process, highlighting bottlenecks and areas for improvement.

- Sales Cycle Length Trend: A line chart displaying the average sales cycle length over time, indicating whether the sales process is becoming more or less efficient.

- Opportunity Count by Stage: A stacked bar chart or a table showing the number of opportunities in each stage of the pipeline, providing a snapshot of deal distribution.

Opportunity-Specific Metrics: Deep Dive into Deal Performance

Opportunity-specific metrics provide a granular view of individual deal performance within the CRM. These metrics allow sales teams to assess the health of each opportunity, identify potential risks, and tailor strategies to improve the likelihood of closure. By focusing on deal-level data, sales managers can provide targeted coaching and support to their sales reps.

Metrics, Purpose, and Impact

Analyzing opportunity-specific metrics enables a deeper understanding of deal performance. The following table Artikels key metrics, their purpose, and their impact on sales:

| Metric | Purpose | Impact on Sales | Data Source |

|---|---|---|---|

| Opportunity Value | Represents the potential revenue from the deal. | Influences revenue forecasts and sales targets. | CRM opportunity record. |

| Close Date | The expected date the deal will close. | Affects revenue forecasting and pipeline management. | CRM opportunity record. |

| Stage Duration | The time spent in each sales stage. | Identifies bottlenecks and inefficiencies in the sales process. | CRM opportunity record, stage history. |

| Probability of Close | The likelihood of the deal closing successfully. | Impacts forecast accuracy and sales strategy. | CRM, sales rep input, lead scoring. |

| Last Activity Date | The date of the most recent interaction with the prospect. | Indicates deal engagement and potential for inactivity. | CRM activity logs. |

Strategies for Improvement

Improving performance based on opportunity-specific metrics requires a proactive approach. Sales managers and reps can use these insights to drive better outcomes:

- Regular Deal Reviews: Conduct regular reviews of each opportunity, focusing on the metrics listed above. Discuss progress, challenges, and strategies for moving the deal forward.

- Coaching and Training: Provide targeted coaching to sales reps based on deal-specific data. Address issues such as stage duration, low close probabilities, and lack of activity.

- Prioritization: Prioritize opportunities based on their value, close probability, and expected close date. Focus efforts on deals with the highest potential for success.

- Action Plans: Develop action plans for each opportunity, outlining the specific steps needed to move the deal through the sales process.

Stage-Based Metrics: Analyzing Conversion Rates and Bottlenecks

Stage-based metrics offer insights into the efficiency of the sales process by analyzing conversion rates and identifying bottlenecks. By tracking how opportunities move through each stage, sales teams can pinpoint areas where deals are stalling and take corrective action. This approach is critical for optimizing the sales pipeline and improving overall performance.

Tracking Conversion Rates

Tracking conversion rates across different sales stages is essential for understanding where deals are being lost or delayed. The following steps are involved:

- Define Sales Stages: Clearly define each stage in the sales process within the CRM (e.g., Lead, Qualification, Proposal, Negotiation, Closed Won/Lost).

- Track Opportunity Movement: Ensure that opportunities are accurately moved through each stage as they progress.

- Calculate Conversion Rates: For each stage, calculate the conversion rate by dividing the number of opportunities that move to the next stage by the total number of opportunities in the previous stage. For example:

Conversion Rate (Stage 2) = (Opportunities Moved to Stage 3) / (Opportunities in Stage 2)

Understanding Pipeline Health Metrics in 2025 is crucial for sales success. Evaluating key indicators allows for data-driven decisions, and even when resources are tight, valuable insights can be gleaned. To start, exploring The Best Free CRM Tools in 2025 (Truly Free Plans Compared) can offer a solid foundation. No matter the CRM choice, focus remains on pipeline metrics for proactive management and improved outcomes.

- Monitor Trends: Track conversion rates over time to identify trends and patterns.

Pinpointing Bottlenecks

Identifying bottlenecks within the pipeline involves analyzing conversion rates and stage durations to determine where deals are getting stuck. Key methods include:

- Low Conversion Rates: Low conversion rates between two stages indicate a bottleneck. For example, a significant drop in conversion from the “Proposal” stage to the “Negotiation” stage suggests issues with the proposal process or pricing.

- Long Stage Durations: Stages with unusually long average durations are potential bottlenecks. Analyze why deals are taking longer to move through these stages.

- Analyzing Lost Deals: Reviewing the reasons why deals are lost can reveal bottlenecks. Common reasons include pricing issues, lack of decision-maker buy-in, or competition.

Addressing Bottlenecks

Addressing identified bottlenecks requires taking actionable steps to improve the sales process. Solutions include:

- Refine Sales Processes: Streamline processes at bottleneck stages. For example, simplify the proposal process or provide more training on negotiation techniques.

- Improve Lead Qualification: Ensure that leads are properly qualified before entering the pipeline to reduce wasted effort.

- Provide Sales Training: Train sales reps on skills needed to overcome challenges at bottleneck stages. This might include training on handling objections or presenting value propositions.

- Adjust Pricing and Proposals: Review pricing strategies and proposal templates to address common objections or concerns.

- Implement Automation: Automate tasks at bottleneck stages, such as sending follow-up emails or generating proposals, to save time and improve efficiency.

Velocity Metrics: Measuring Speed and Efficiency in the Sales Process

Velocity metrics are essential for assessing the speed and efficiency of the sales process. These metrics measure how quickly deals move through the pipeline and provide insights into potential areas for improvement. By understanding deal velocity, sales teams can forecast revenue more accurately and identify opportunities to accelerate the sales cycle.

Importance of Velocity Metrics

Velocity metrics are crucial for several reasons:

- Revenue Forecasting: They help forecast revenue by providing insights into the pace at which deals are closing.

- Process Efficiency: They reveal inefficiencies in the sales process, such as bottlenecks or delays.

- Performance Improvement: They enable sales teams to identify areas for improvement and optimize the sales cycle.

- Resource Allocation: They help allocate resources effectively by highlighting the time and effort required to close deals.

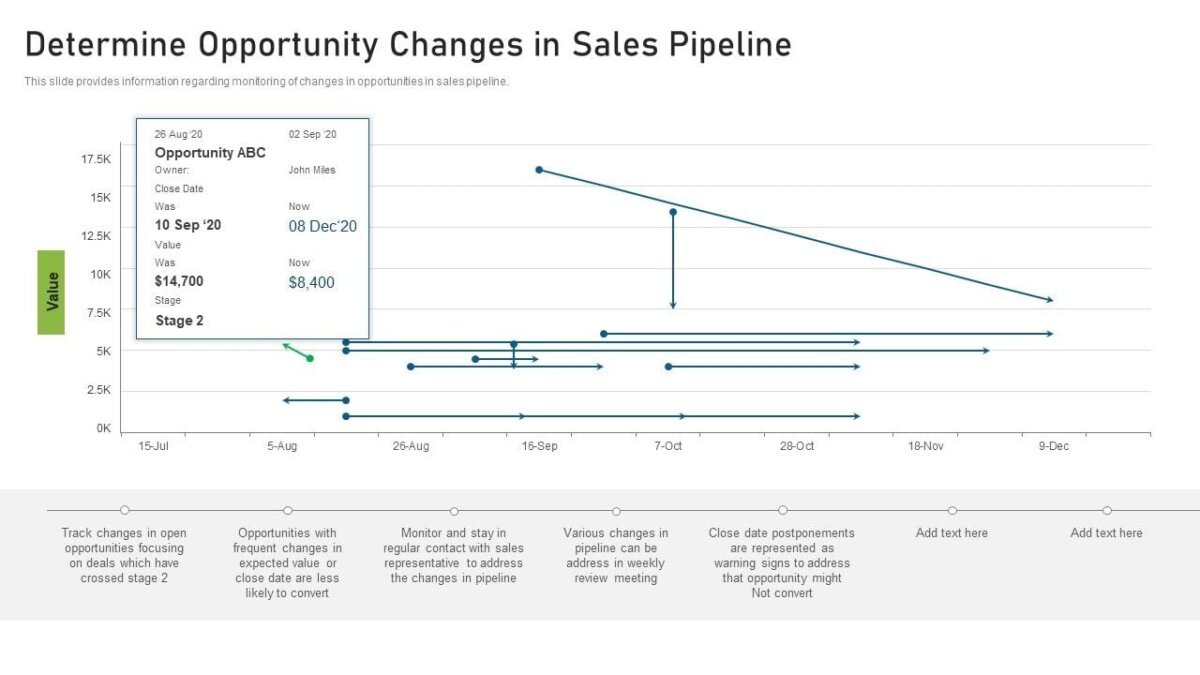

Determining Deal Velocity

Source: slidegeeks.com

Deal velocity is calculated using the following formula:

Deal Velocity = (Number of Opportunities x Average Deal Value x Win Rate) / Sales Cycle Length

Where:

- Number of Opportunities: The total number of opportunities in the pipeline.

- Average Deal Value: The average value of closed deals.

- Win Rate: The percentage of opportunities that are successfully closed.

- Sales Cycle Length: The average time it takes for a deal to move from the initial stage to closure.

Using Velocity Metrics

Source: botpenguin.com

Velocity metrics can be used to forecast revenue and identify areas for improvement. For example:

- Forecasting Revenue: Use the deal velocity formula to estimate the revenue that can be generated within a specific timeframe. Adjust the forecast based on changes in the pipeline, deal value, or sales cycle length.

- Identifying Bottlenecks: Analyze the sales cycle length component of the velocity formula. If the sales cycle length is increasing, it indicates potential bottlenecks.

- Optimizing the Sales Process: Implement strategies to reduce the sales cycle length, such as streamlining processes, improving lead qualification, or providing sales training.

- Measuring Performance: Track deal velocity over time to measure the impact of process improvements.

Forecast Accuracy Metrics: Improving Prediction Capabilities

Forecast accuracy metrics are crucial for measuring the reliability of sales predictions. Accurate forecasts enable better decision-making, resource allocation, and financial planning. By tracking these metrics, sales teams can refine their forecasting processes and improve their ability to predict future revenue.

Key Metrics for Forecast Accuracy

Several key metrics are used to measure the accuracy of sales forecasts:

- Forecast Accuracy Percentage: The percentage of the forecast that is realized. Calculated as (Actual Revenue / Forecasted Revenue)

– 100. A percentage close to 100% indicates high accuracy. - Pipeline Coverage Ratio: The ratio of the pipeline value to the sales target. A higher ratio indicates a greater likelihood of achieving the target. Calculated as (Pipeline Value / Sales Target).

- Weighted Pipeline: The sum of the value of each opportunity multiplied by its probability of closing. Provides a more realistic view of potential revenue.

- Forecast Variance: The difference between the forecasted revenue and the actual revenue. This metric can be tracked as a percentage or a dollar amount.

- Upside/Downside Forecasts: Analysis of optimistic (upside) and pessimistic (downside) revenue scenarios.

Assessing Forecast Accuracy

Assessing the accuracy of sales predictions involves the following framework:

- Data Collection: Gather historical sales data, including forecasts and actual revenue.

- Calculation: Calculate the key metrics listed above.

- Analysis: Analyze the metrics to identify patterns and trends. For example, is the forecast consistently over or under-predicting revenue?

- Benchmarking: Compare the forecast accuracy metrics against industry benchmarks or internal goals.

- Review and Adjustment: Regularly review the forecasting process and make adjustments based on the analysis.

Best Practices for Improvement

Improving forecast accuracy requires a data-driven approach. Best practices include:

- Regular Forecast Reviews: Conduct regular reviews of sales forecasts, ideally monthly or quarterly.

- Data-Driven Adjustments: Make adjustments to forecasts based on historical data, pipeline activity, and market trends.

- Sales Rep Training: Train sales reps on accurate forecasting techniques and the importance of providing realistic estimates.

- Pipeline Management: Implement robust pipeline management practices, including accurate stage progression and deal qualification.

- Use of Technology: Leverage CRM systems and forecasting tools to automate data collection, analysis, and reporting.

Engagement Metrics: Assessing Sales Team Activity and Customer Interaction

Engagement metrics are vital for assessing sales team activity and customer interaction within the CRM. These metrics provide insights into how sales reps are interacting with prospects and customers, and how effective those interactions are. By monitoring engagement, sales managers can optimize sales strategies and improve overall performance.

Understanding Pipeline Health Metrics is crucial for any CRM in 2025, providing vital insights into sales performance. Choosing the right platform is paramount, which is why comparing features is essential. Delving into the details of how these systems stack up, you can explore a comprehensive feature comparison in Salesforce vs HubSpot vs Dynamics 365 (2025): Feature-by-Feature Showdown to ensure you are measuring the right pipeline health metrics.

Ultimately, the best CRM empowers you to track and optimize your sales process effectively.

Identifying Engagement Metrics

Several engagement metrics reflect sales team activity and customer interaction:

- Number of Calls Made: The total number of outbound calls made by sales reps.

- Number of Emails Sent: The total number of emails sent to prospects and customers.

- Meetings Scheduled: The number of meetings scheduled with prospects and customers.

- Response Rates: The percentage of emails or calls that receive a response.

- Average Response Time: The average time it takes for a sales rep to respond to an inquiry or request.

- Customer Interaction Frequency: The frequency of interactions with each customer or prospect.

- Content Engagement: Tracking of how prospects and customers interact with content, such as website visits, downloads, or webinar attendance.

Monitoring and Analyzing Engagement Metrics

Monitoring and analyzing engagement metrics involves the following process:

- Data Collection: Ensure that the CRM system accurately tracks all relevant engagement data. This might involve integrating with email, phone, and marketing automation tools.

- Reporting and Dashboards: Create reports and dashboards that display engagement metrics in an easy-to-understand format.

- Analysis: Analyze the data to identify trends and patterns. Look for areas where engagement is high or low, and correlate engagement metrics with sales outcomes.

- Segmentation: Segment data by sales rep, customer segment, or product to identify areas for improvement.

- Regular Review: Conduct regular reviews of engagement metrics to identify areas for improvement.

Leveraging Engagement Data

Leveraging engagement data to optimize sales strategies includes:

- Personalization: Use engagement data to personalize sales interactions. Tailor messaging and content to the specific needs and interests of each prospect or customer.

- Prioritization: Prioritize sales efforts based on engagement levels. Focus on prospects and customers who are actively engaged and show a higher likelihood of converting.

- Training and Coaching: Provide sales reps with training and coaching based on their engagement performance. Address areas where they may need improvement.

- Content Optimization: Analyze engagement with different types of content to identify what resonates with prospects and customers. Use these insights to optimize content strategy.

- Automation: Automate follow-up sequences and other tasks based on engagement triggers. For example, send an automated email to a prospect who downloads a specific piece of content.